Sobre Mí

arizona casino winning taxes

CLICK HERE PICTURE

Your gambling winnings are generally subject to a flat 24% tax.

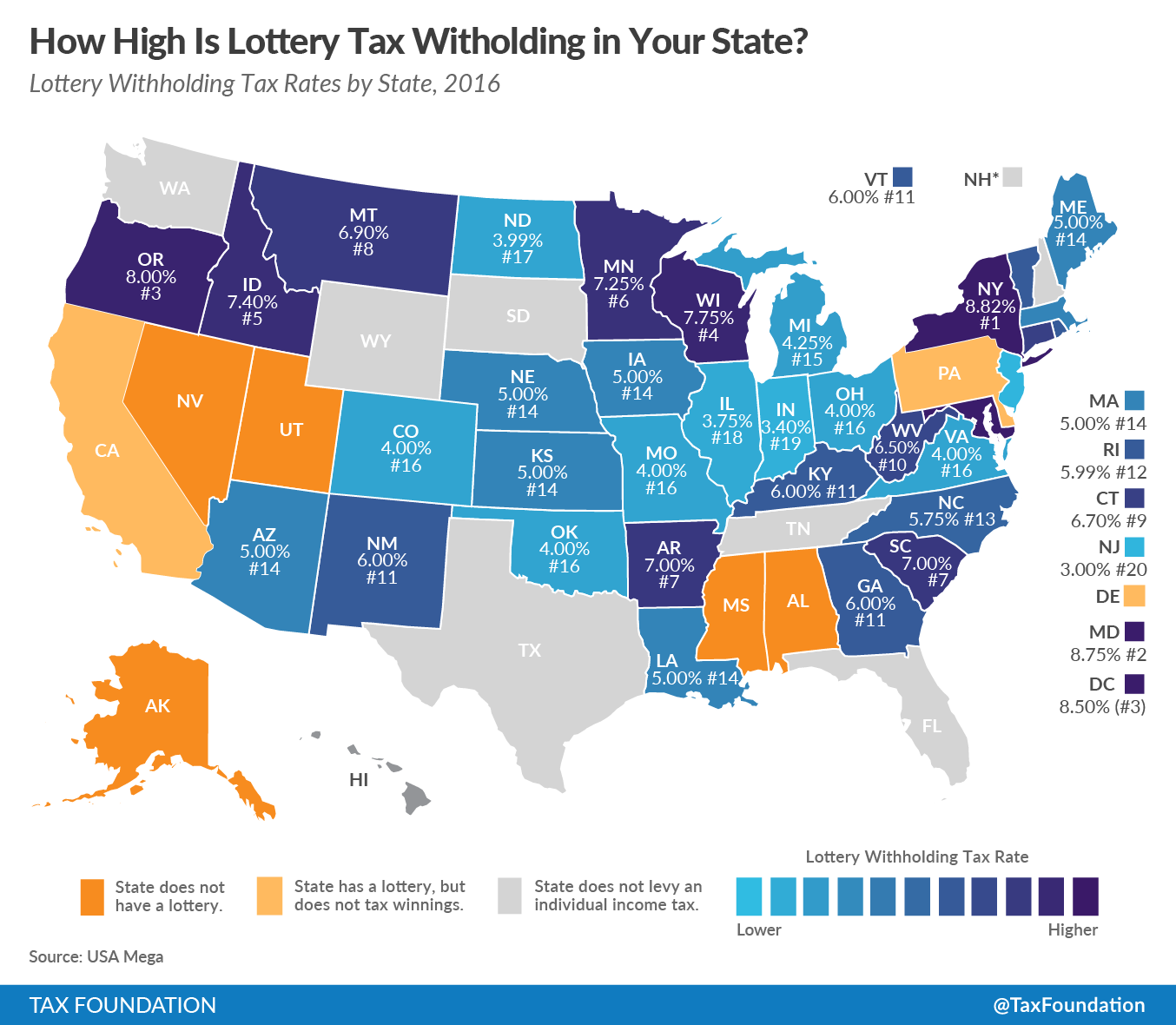

Lotteries, casinos, race tracks, and other games of chance often are proposed as ways to raise tax revenue for the state, with varying results. What all of these.

Gambling income plus your job income (and any other income) equals your total income. Fortunately, you do not necessarily have to pay taxes on.

The IRS considers any money you win gambling or wagering as taxable income. The threshold for which gambling winnings that must be reported to the IRS.

Here's the truth with gambling taxes: both cash and noncash gambling winnings are fully taxable. What Are Cash Winnings? Cash winnings include money you.

Gambling losses must be adjusted to reflect the exclusion for lottery winnings. Arizona Tax Rates. Single; Married Filing Jointly; Married Filing Separately?.

If you are lucky enough to win when you go to the casino, you will not necessarily have to report the winnings on your tax returns.

Topic:Arizona State Tax On Gambling Winnings Arizona state tax on gambling winnings on powered by Peatix : More than a ticket.

9 Total gambling winnings included in your federal adjusted gross income . as a federal itemized deduction that relates to income not subject to Arizona tax.

Arizona Revised Statutes Title 43 - Taxation of Income § Extension of withholding to gambling winnings For the purposes of this title, payments of.

The gambling income of a professional gambler is taxed at the normal effective income tax rate. Reporting Gambling Winnings.

Additionally, patron hereby agrees to indemnify Casino Arizona/Talking Stick.

In the U.S., there is a withholding tax that applies to the gambling or lottery winnings of non-residents. The casino (or gambling establishment) is.

A Las Vegas Casino Win/Loss statement is an estimate of what an individual casino customer won or lost during a Arizona Charlie's Boulder.

A complete guide to legal gambling in Arizona. Arizona Gambling Laws State Flag Icon Do you need to pay taxes on gambling winnings in Arizona?

Casino winnings are taxed as ordinary income and can bump winners to a higher tax bracket.

Gambling Winnings Subject to Tax? With all sports betting, casino, poker, daily fantasy, and state lotteries, is the government entitled to a fair.

They gave him a check for the full amount. You could owe more tax, or you may get a refund. With many ways to file your taxes , including online or in-office, we can fit your needs and guarantee an accurate tax return. Opus 17. US State Law. Accessed Jan. If you itemize your deductions, you can deduct your gambling losses for the year on Schedule A. For this 's counterpart in, see. But beginning with the tax year 2018 the taxes filed in 2019 , all expenses in connection with gambling, not just gambling losses, are limited to gambling winnings. Online gambling taxes do have a few gray areas. Enter a search word. The base for taxation in Arizona starts with federal adjusted gross income. The short answer is yes. Subscribe to Our Newsletter Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. States can use either a joint system, a combined system, or a combination of the two in order to determine income amounts to be taxed. Why do I have to file this again , if it was already deducted at the lottery office? Search instead for. Does he owe taxes? Key Takeaways Unlike income taxes, gambling taxes are not progressive. Business Essentials.

Ubicación

Zona horaria

Ocupación

Firma

Gambling Winnings and Deducting Losses

FORO ACADÉMICO

En la antigua Roma, en la plaza se trataban los negocios públicos y se celebraban los juicios, hoy este espacio digital es la abstracción de ese lugar físico, con personas competentes en disciplinas sociales humanas y artísticas con el objetivo de construir un diálogo enmarcado en el respeto y el deseo de aprender.

REGLAS DEL FORO

Contenido no deseado los mensajes automatizados, anuncios y enlaces a sitios web sospechosas se eliminarán de inmediato.

Pública solo en subforos relevantes. Los mensajes publicados en el área temática incorrecta serán eliminados y colocados en el subforo correcto por los moderadores.

Respeta a los demás usuarios. No insultar a otros miembros del foro. Los usuarios que continúen publicando comentarios ofensivos serán eliminados del foro después de que los moderadores emitan una advertencia.

Acoso. No se tolerarán amenazas ni acoso de otros usuarios. Cualquier instancia de comportamiento amenazante o acosador es motivo de eliminación de los foros.

Contenido para adultos. No se permiten blasfemias ni pornografía. Se eliminarán las publicaciones que contengan material para adultos.

Contenido ilegal. No se permite la re-publicación de materiales con derechos de autor u otro contenido ilegal. Se eliminarán todas las publicaciones que contengan contenido ilegal o material protegido por derechos de autor.